Platform

Transfer Agent

Traditional Transfer Agents perform the following functions:

- Issue and cancel certificates to reflect changes in ownership. For example, when a company declares a stock dividend or stock split, the transfer agent issues new shares. Transfer agents maintain the record of who owned how much of at any given time.

- Act as an intermediary on behalf of private issuers. A transfer agent may pay out interest, cash, and stock dividends, or other distributions to stock and bondholders. Also, transfer agents may act as proxy agent, exchange agent, tender agent, and mailing agent.

- Handle lost, destroyed, or stolen certificates. Transfer agents may invalidate and reissue stock certificates in certain instances.

What is a Digital Transfer Agent?

Digital Transfer Agents such as Vertalo, an SEC Registered Transfer Agent (TA), incorporate advanced technology including API connections, attractive user interfaces, and on- and off-chain data management to provide a suite of services, under a single, secure and integrated platform, including:

- Provide shareholder registry management tools and interfaces

- Monitor issuances and transfers

- Act as an intermediary for dividends and payments

- Maintain a ledger of stakeholders

- Facilitate proxy votes

- Handle payments and settlement

- Enable tokenization of securities and private assets, including REITs

- Create encrypted and immutable ownership records

- Provide investors with keyless wallets

- Enable investors to access their ownership records through a web-based user interface using their email address and password

- Initiate changes in protocol (chain swap)

How do Digital Transfer Agents differ from Traditional Transfer Agents?

- Vertalo, as a DTA, provides the services of a traditional Transfer Agent, with the additional benefit of digital enablement. Vertalo connects and empowers issuers within the Security Token Ecosystem.

- Vertalo provides Issuers with the flexibility to tokenize their offering either before or after issuance and maintain both traditional and digital securities in their cap table and shareholder registry.

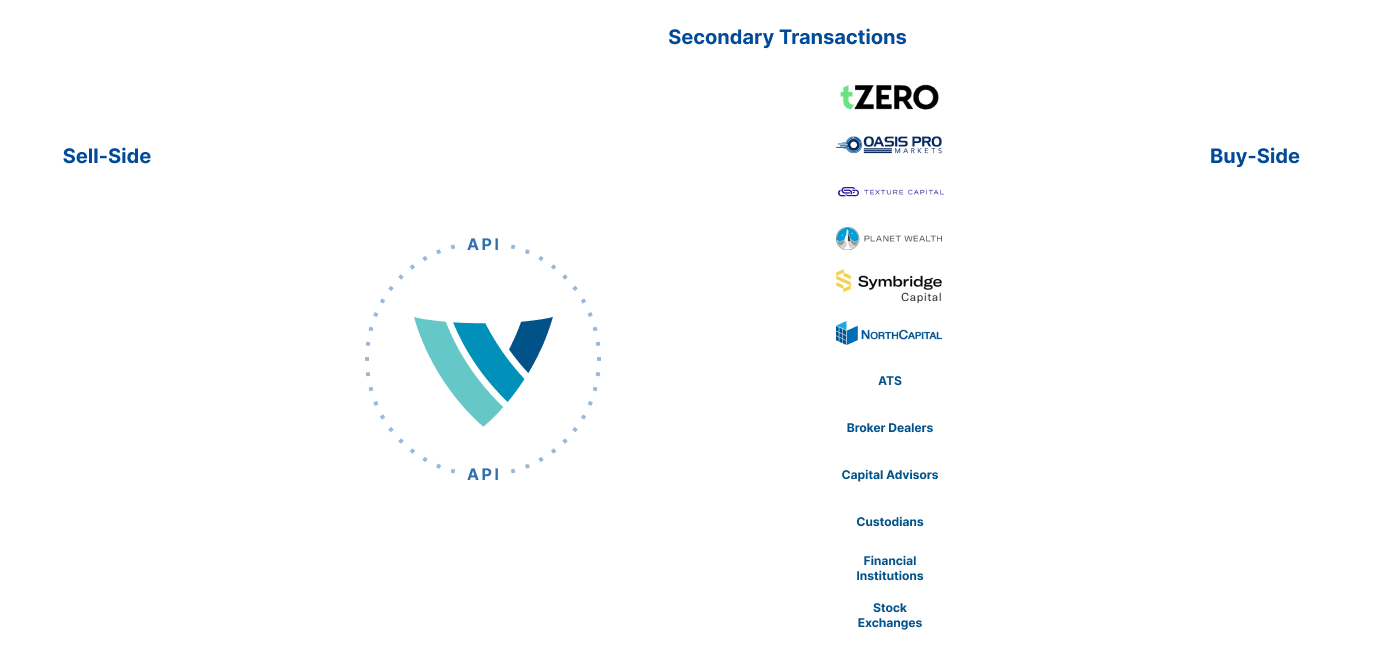

- The result is that Issuers future-proof their offerings in a Digital Age. Through Vertalo’s connectivity to Alternative Trading Systems (ATSs), Custodians, Broker-Dealers, RIAs, Token Issuance Platforms, Escrow Services, KYC/AML and Accreditation Services, issuers are empowered to bring their offerings into the 21st century.

Vertalo enables Digital Asset Management.

Careers | FAQ | Newsletter | Partners | Request Transfer | Tech Blog

Questions about your shares? Please contact your issuer.